The Union environment ministry has now made way for their round the year presence and across all coastal states — a move expected to boost tourism and the coastal economy.

Mudra loan NPAs at just 3.3% in 7 years

Mudra loans do not require any collateral/ security, and hence were perceived to be very risky. But Non-performing assets of banks for Mudra loans – including those extended during the Covid-19 pandemic when small enterprises were the worst hit – are lower than the average NPAs of the sector as a whole. Bad loans under the Pradhan Mantri MUDRA Yojana for all banks (public, private, foreign, state cooperative, regional rural and small finance) since the launch of the scheme on April 8, 2015, is just 3.38 per cent of the total disbursements of Rs 13.64 lakh crore under the scheme during the period, almost half of the banking sector as a whole which stood at 5.97 per cent for the year-ending March 31, 2022.

The Micro Units Development & Refinance Agency (MUDRA) was launched on April 8, 2015, by Prime Minister Narendra Modi to provide loans up to Rs 10 lakh to non-corporate, non-farm, small and micro enterprises. Called the Pradhan Mantri Mudra Yojana, loans are given under three categories: Shishu up to Rs 50,000, Kishore Rs 50,001 to Rs 5 lakh, and Tarun from Rs 5 lakh to Rs 10 lakh.

Within the three categories, the NPAs for Shishu loans (up to Rs 50,000) were the lowest at 2.25 per cent of disbursements and the highest for Kishore loans (Rs 50,001 to Rs 5 lakh) at 4.49 per cent. For Tarun loans (over Rs 5 lakh up to Rs 10 lakh), bad loans were 2.29 per cent of disbursements.

Public sector banks accounted for almost 46 per cent of all Mudra loans in value term, while Private Sector banks account for 36 per cent. In terms of the number of accounts they catered to, Private Banks serviced 10.46 crore beneficiaries or almost 53 per cent of the total 19.78 crore loan accounts. Public sector state-owned banks covered 4.66 crore beneficiaries, or under 24 per cent of the total Mudra loan accounts.

Public sector banks accumulated bad loans of Rs 31,025.30 crore, which is 4.98 per cent of their disbursements of Rs 6,23,279.85 crore. Private banks have far better recovery. For them, bad loans or non-performing assets during the seven-year period stood at Rs 6,469.2 crore, just 1.32 per cent of their disbursements of Rs 4,90,652.6 crore.

Share this article:

Recommended For You

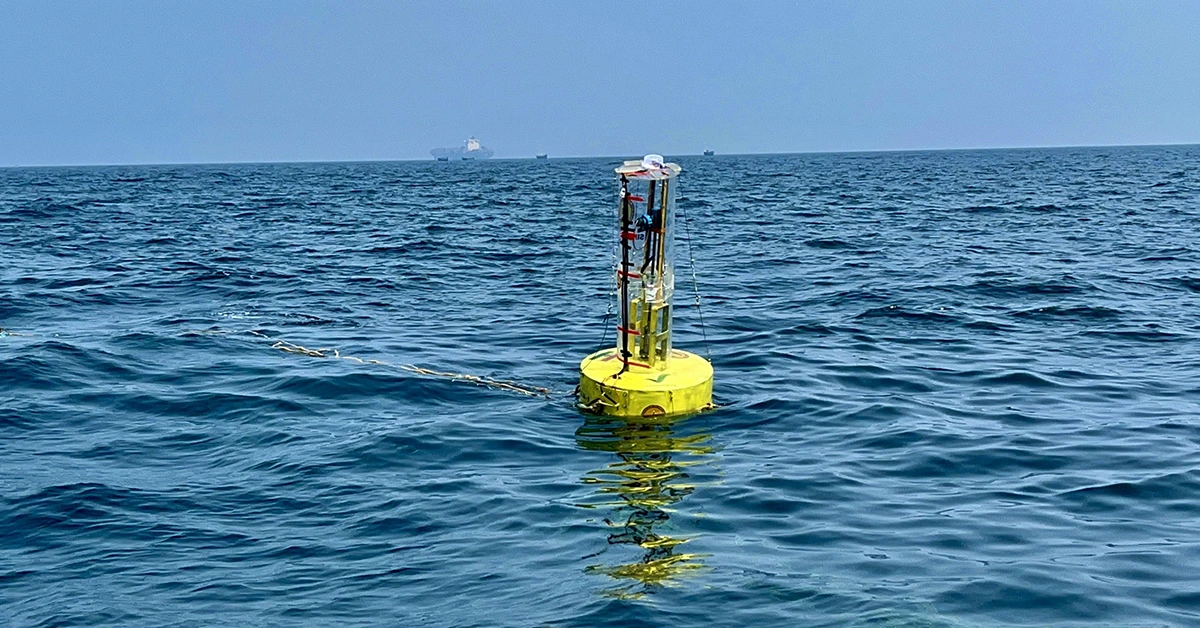

IIT Madras researchers have developed an ocean wave energy converter system, named Sindhuja-I, to generate electricity from sea waves.

As the IECC opens its doors to the world, it ushers in a new era of possibilities, propelling India towards greater economic growth, development, and recognition as a leading force in the international arena. With its grandeur and vision, the IECC stands tall as a symbol of India's aspirations to →Read More →

The civil aviation ministry has allowed Indian airlines to take wide-body planes on wet lease for up to one year as it pursues efforts to make the country a key international hub for air traffic.

Today, a much-needed government boost to the global imprint of Indian toys is evident from Modi government’s emphasis on bringing in transformative changes in the domestic toy industry by promoting “Vocal for Local" and “Make in India" under the Aatmanirbhar Bharat scheme. India under Narendra Modi has made a beginning →Read More →

With the aim to grow the state's economy to USD 1 trillion, Chief Minister Yogi Adityanath government said it will transform western and central Uttar Pradesh into a hub for the auto and electric vehicle industries as well as its supporting parts.

Piyush Goyal introduced the Jan Vishwas Bill, 2022, to decriminalize minor offences to promote ease of business.

India's retail inflation, as measured by the consumer price index (CPI), eased to 5.72 per cent in December on an annual basis as against 5.88 per cent in November, 2022.